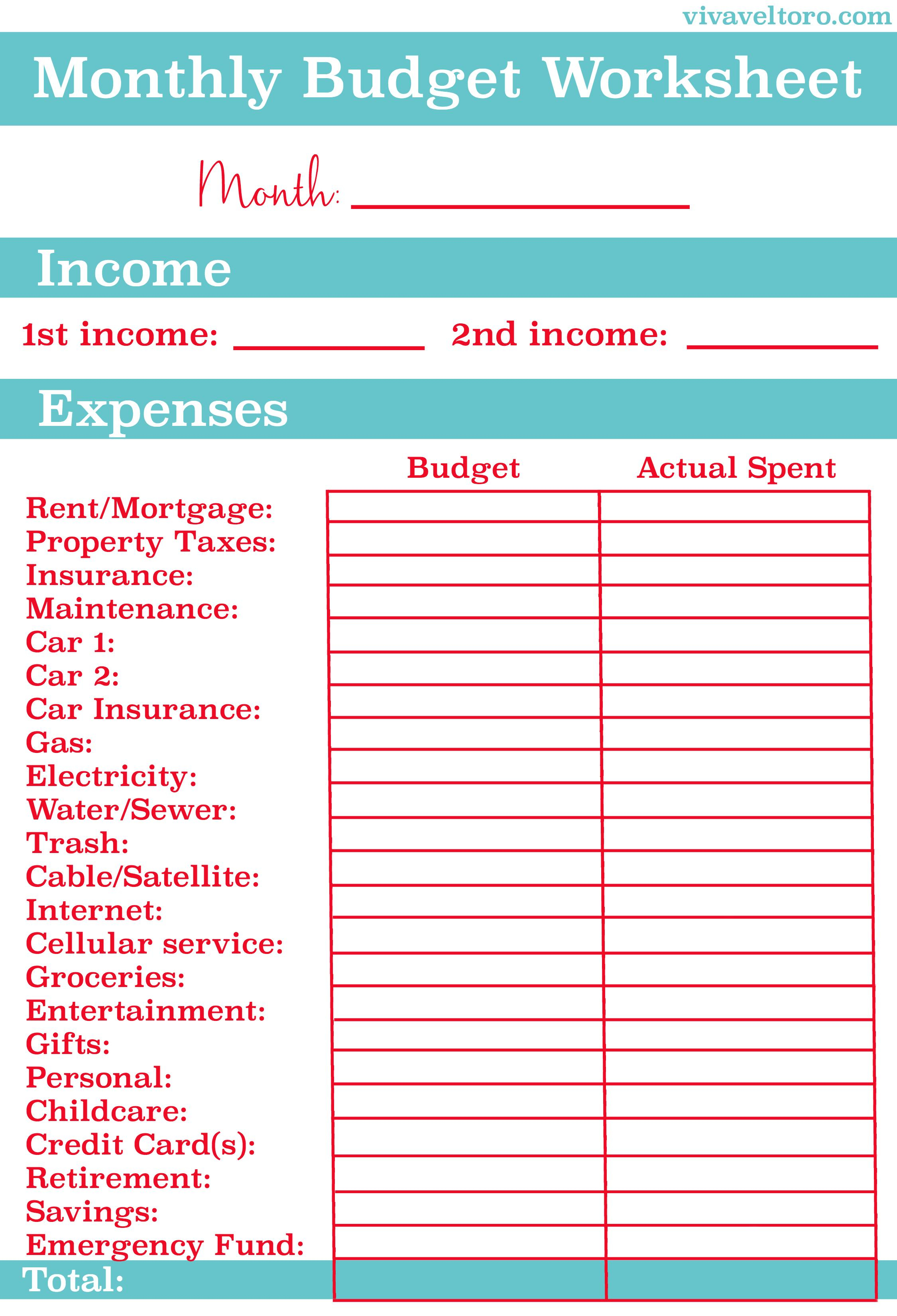

For example, can you refinance your mortgage at a lower rate? Can you reduce your food bill? But above all, decide you are going to stick with your budget to achieve your goals. Do not set your expense reduction goals so high that you will get discouraged.Īlso, you should look at all your expenses. Will help you determine what is working and what is not. If you are married, you and your spouse must agree on what to spend. You must set goals on reducing your expenses. Decide on what you need vs. Calculate your monthly income, pick a budgeting method and monitor your progress. What are your short, medium, and long term goals? Getting out of debt? College education? Retirement? Having savings goals will help you determine how much you must cut out of your expenses. Most people are surprised about what they spend on certain items over the course of a month. The best way to do this is to figure out what you need to spend to survive. If you have an irregular or fluctuating income, it’s true that it can be harder to create a monthly budget. If you were to cash your paycheck the money received is your net income. These household budget percentages are recommended by experts for helping you create - and stick to - your ideal household budget. every month, put it in the Other expenses this month category. If you have an expense that does not occur. Some bills are monthly and some come less often. information to help you plan next month’s budget. pdf-1020-make-budget-worksheetform.pdf (507. Make a Budget Use this worksheet to see how much money you spend this month. Also, use the worksheet to plan for next month’s budget. You want a form you understand and can work with. Use this worksheet to see how much money you spend this month. This will be your primary budgeting tool. You can find examples in personal finance books at the library or we have forms available. To do that, you need to work out how much you can spend on different areas of your life.

The aim is to have your books balancing so youre not spending more than you earn. A household budget allows detailed, specific, accurate, and transparent data about future and current funds. It is a financial plan that allocates future funds and income towards expenses, savings, or debt repayment. Find a budget form or example you like. Step 1: Select your main categories of spending. What Is a Monthly Household Budget A monthly household budget contains similarities to a personal budget or a home budget.

Monthly household budget how to#

Here are some tips on how to get started with your own household budget: You determine your income and expenses, and then set spending goals for those expenses. The purpose of a household budget is to summarize what you earn against what you spend to help you plan for long and short-term goals. A budget is your household spending plan.

0 kommentar(er)

0 kommentar(er)